Content

Sign Up NowGet this delivered to your inbox, and more info about our products and services. Gross margin is 25.60%, with operating and profit margins of 16.76% and 15.41%. The company has a current ratio of 1.53, with a Debt / Equity ratio of 0.07.

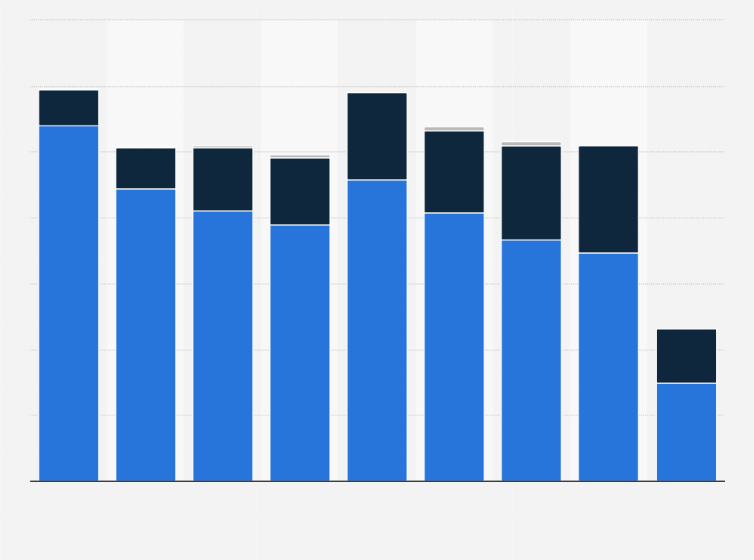

Similar to the PE Ratio without NRI or PS Ratio or Price-to-Operating-Cash-Flow or Price-to-Free-Cash-Flow , the PE Ratio measures the valuation based on the earning power of the company. This is where it is different from the PB Ratio , which measures the valuation based on the company’s balance sheet. Because the PE Ratio measures how long it takes to earn back the price you pay, the PE Ratio can be applied to the stocks across different industries. That is why it is the one of the most important and widely used indicators for the valuation of stocks.

Industry Products

As the world’s only fully integrated sustainable energy company, Tesla is at the vanguard of the world’s inevitable shift towards a sustainable energy platform. At the center of everything we do is a strong commitment to independent research and sharing its profitable discoveries with investors. This dedication to giving investors a trading advantage led to the creation of our proven Zacks Rank stock-rating system. Since 1988 it has more than doubled the S&P 500 with an average gain of +24.52% per year.

We recently changed our fair value estimate—here’s what we think the stock is worth. Take your analysis to the next level with our full suite of features, known and used by millions throughout the trading world. Tesla has announced price cuts to some of its EV models in the US.

Tesla PE Ratio: 54.71 for April 3, 2023

Market capitalization is calculated by taking a company’s share price and multiplying it by the total number of shares. In the Morningstar Style Box, large-cap names account for the largest 70% of U.S. stocks, mid-cap names account for the largest 70–90%, and small-cap tesla current pe ratio names are the remaining 10% of companies. The detailed multi-page Analyst report does an even deeper dive on the company’s vital statistics. It also includes an industry comparison table to see how your stock compares to its expanded industry, and the S&P 500.

Does Tesla have a good PE ratio?

About PE Ratio (TTM)

Tesla, Inc. has a trailing-twelve-months P/E of 47.98X compared to the Automotive – Domestic industry's P/E of 10.40X. Price to Earnings Ratio or P/E is price / earnings. It is the most commonly used metric for determining a company's value relative to its earnings.

3.13 Billion Avg 30 Day Volume The number of shares traded in the last 30 days. This article is general information and for entertainment purposes only. Please do you own due diligence regarding any security directly or indirectly mentioned in this article. You should also seek advice from a financial advisor before making any investment decisions.

Dividends & Yields

The company also plans to begin selling more affordable sedans and small SUVs, a light truck, a semi truck, and a sports car. Global deliveries in 2022 were a little over 1.3 million vehicles. The market capitalization sometimes referred as Marketcap, is the value of a publicly listed company. In most cases it can be easily calculated by multiplying the share price with the amount of outstanding shares. Price/book ratio can tell investors approximately how much they’re paying for a company’s assets, based on historical, rather than current, valuations.

- Global deliveries in 2022 were a little over 1.3 million vehicles.

- 60 minutes featuring the brightest minds on Wall Street, taking you through the most important hour of the trading day.

- $3.62 Price to Sales Ratio Market cap divided by the revenue in the most recent year.

- Data by YCharts When you factor in the debt and consider enterprise value to earnings, you realize Tesla is valued at least slightly closer to its peers than their PE values alone would suggest.

Like it or not, Musk’s larger than life personality is why Tesla hasn’t had to advertise. With a macro foundation , we offer actionable investment strategies that allow clients to make money in any market environment. Otherwise, if the company price multiple is higher then the price multiple of benchmark then company stock is relatively overvalued. If the company price multiple is lower then the price multiple of benchmark then company stock is relatively undervalued.